The following contribution is from another author.

In Texas, there are plenty of options if you’re looking for something to invest in. You might buy into a franchise if you like the idea of being a business owner but don’t have an idea for a company of your own. You might invest in undeveloped land and try to develop it if you have a notion as to what might do well in that particular area.

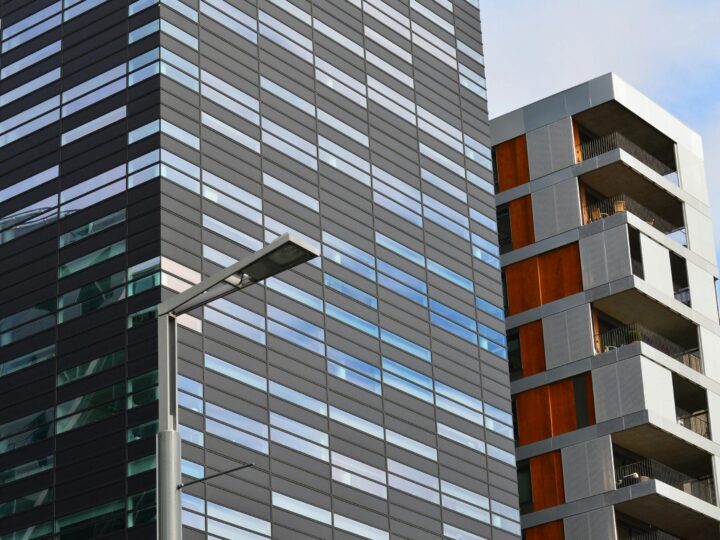

Austin construction services are always available if you’re targeting that region. It’s thought of as one of the more desirable cities in all of Texas by some individuals, so it’s not an unreasonable idea at all.

In a more general sense, though, you might not be sure about why you should invest in commercial properties in Texas. Here are a few reasons why you may want to give the notion some serious thought if you have money to spend in the Lone Star state.

Texas Shows Impressive Population Growth

A moment ago, we mentioned Austin. That’s a city that is seeing pretty incredible population growth at the moment, and it shows no signs of slowing down anytime soon.

Across the state, though, population numbers are going up. The demographics of Texas may be changing rapidly, but there’s no denying that many individuals see plenty of reason to move there.

More people mean more individuals looking for jobs. With that in mind, investing in commercial properties in Texas might very well appeal.

There’s Stability in Holding Onto Real Estate

If you invest in real estate, that’s also usually a way you can get stability for your investment. If you put money in the stock market, there are ways to do it more safely, though you may see a lower rate of return. There are also plenty of other investment vehicles, but some of them may seem too volatile for you to take them seriously.

Investing in real estate is usually one of the most sensible things you can do with your money if you’re thinking about a long-range return. The real estate market does not typically see the wild fluctuations some others do.

The Worth of Real Estate Usually Goes Up as Time Passes

It’s also true that if you invest in real estate, you’re putting your money into something that almost always becomes more valuable over time. You occasionally see exceptions to this rule, but it doesn’t happen often.

If you sit on a piece of property for long enough, whether it’s commercial or residential, the chances are great that when you decide to sell it, you can do so at a profit. If you aren’t looking to flip a property quickly, having it as a part of your portfolio for decades is not a bad idea.

You Can Rent a Structure, Thereby Making Passive Income

If you rent a commercial property in Texas, you can also make passive income off of it. You will have maintenance fees to think about, but you can usually more than offset them by collecting rent from whatever company or companies decide to set up shop there.

The renting out of property can lead to you making money without having to do very much, especially if you have a reliable business entity that helps you keep the property desirable. Since passive income is a goal for many individuals, putting yourself in the best position to collect it will seem like a can’t-miss plan for many Texas residents with money to spend.

There is a Thriving Tech Industry

If you look at the industries that are thriving in Texas, tech is one that stands out. There are more and more companies heading there that operate within the technology niche in one way or another.

That’s great news for commercial property owners, especially in the major cities. If you own a piece of commercial property and rent it out to a tech company, they will probably need that space for their servers or to work on their proprietary technology.

There’s a Pro-Business Environment

There is also a notable pro-business environment in Texas that makes the idea of owning commercial property there an attractive one. If you’re operating a rental property in a state that wants manufacturing, research, and other business-related activities to find a home there, you make it highly likely you will be able to find a renter with a minimum of effort.

You Can Often Find Individuals to Go in on a Property with You

If you feel like you can’t afford to buy a commercial property in Texas by yourself, you should also be pleased to know that finding other individuals to go in on one with you should not be all that difficult.

You can probably locate other like-minded individuals who also have money to invest in such an endeavor. If you have an ownership group that has a vision of the future that seems much like yours, it can be a marriage of convenience that yields significant financial dividends for everyone involved.

Commercial Properties Usually Have Higher Rates of Return on Your Investment

You should also think about the return on your investment that you can usually get with commercial properties vs. residential ones. It’s true that you can make money off of residential properties by renting them out, but you might do even better if you have commercial buildings in your portfolio.

You will see an average annual return of anywhere from 6% to 12% on a commercial investment, significantly more than what you will get with most residential properties. Those numbers can translate to cash in your pocket every year if you manage your property wisely.

You Can Secure Longer Lease Agreements

You can also usually get longer lease agreements from the companies that rent your commercial properties than what you will see from families or individuals who rent your residential ones. A lease agreement with a company might be for three, five, or even 10 years. You’ll be lucky if you can get anywhere near that with a residential occupant.