…As long as you know what you’re doing.

“Dave Ramsey gave us bad advice!” That’s the first thing I told my wife when I realized all we missed out on from living off our debit cards. Like many of you reading this, we’ve always done the best we can to live responsibly, stay away from debt, and save and invest wisely. We thought that meant staying away from credit cards entirely, but man was that a mistake.

As we watched friend-after-friend fly all over the country and take big trips during the year, we knew there was something we had to be missing out on. As it turns out, responsibly using credit cards is one of the biggest life hacks that we had never taken advantage of.

The following is an EASY guide to everything we’ve learned over the past few years. If this is new to you like it was new to us, I promise it will turn your world upside down.

Credit Cards Actually Save Me Money?!

So, back to Dave Ramsey. Let me say this up front… His financial advice has been a huge blessing to our lives and our marriage. His simple advice for saving, investing, and more has absolutely set us up for success and helped us sleep easy at night. However, because of his stances on credit cards, we also missed out on years of bonuses and consumer protections that debit cards just don’t provide.

Let me say this up front (since it’s where all the anti-credit card sentiment lies): DO NOT SPEND MONEY YOU DON’T HAVE. Don’t EVER carry a balance on a credit card. It’s financially stupid, and will ruin your financial life.

HOWEVER…

If you budget and spend responsibly, paying off your statements in full every month with money you already have set aside, credit cards are absolutely the way to go. It’s not even close. Here’s why:

- You’re liable for less fraud. You can look up more on this on Google, but I was shocked to discover how much greater the fraud protections are for purchases with a credit card vs using a debit card.

- You can get automatic insurance, free extended warranties, and more. Use the right card (like the ones I mention below) and you’ll get extra extended warranties, theft protection, and even extensive travel insurance, all for free.

- You can easily earn 3-5% cash back on many purchases. Debit card cash back programs exist, but they’re pathetic.

- You can earn thousands of dollars in bonuses every quarter! More on this below.

Basically, once you choose the right card, all you have to do is swipe that card instead of your debit card at the register, then pay it off once a month with three clicks. Change that one aspect of your wallet, and a whole world of stupid easy freebies is opened up to you. Here’s where to start…

Choosing the Right Card and Rewards Program

TL;DR – Start with the Chase Sapphire Preferred card and use Chase’s Ultimate Rewards program.

Capital One and AMEX have some great programs, but no rewards program is quite as valuable as Chase’s Ultimate Rewards (UR) points. They’re easy to redeem, transfer with a ton of partners, and can be crazy valuable if you play your cards right. We’ll talk more about that in a second.

Now, you can use UR points for cash back and all sorts of other things, but by far their most valuable use is for travel, which is what the rest of the post is going to be built around.

Your First Card (and 60,000 points) – The Chase Sapphire Preferred

The Chase Sapphire Preferred is a brainlessly simple first step into the travel rewards game. Here’s what it gets you:

- Access to the Chase travel portal with 5x points back

- 25% points bonus if you use your points to book travel through the Chase portal

- 3x points for all dining

- 2x points on travel

- 3x points on online groceries

- 3x points on streaming services

- Travel insurance built-in: trip delay/cancellation, lost luggage, rental car insurance, etc

- 60,000 pts right out the gate as a sign up bonus (sometimes up to 80,000)

- $50 off one hotel stay every year

…plus a bunch of other random perks that change throughout the year. This card does have an annual fee ($95/yr), but you effectively knock $50 off of that with the hotel credit and the massive points bonus.

What Makes This Card So Special?

Three things: the huge signup bonus, all the travel benefits, and access to point transfer partners.

First off, the Sapphire Preferred has a consistently high sign up bonus of at least 60,000 ultimate rewards points. As long as you can spend $4,000 through the card in 3 months (surprisingly easy), you’ll get those points deposited to your account. That’s worth $600 cash back (but don’t do that), $750 on the Chase travel portal (thanks to the 25% bonus), or $1800 with the right travel partner (more on that in a second).

Second, as mentioned above, all of the included travel perks and benefits stack up quick. You basically never have to buy travel insurance or rental car insurance again, which might be worth the cost of admission in and of itself.

Finally, the Chase Sapphire cards give you access to Chase’s travel portal (the best rates out there, plus a 25% point bonus when you use UR points), and more importantly, a huge list of transfer partners. Rather than lock yourself into a rewards card that only lets you spend at one hotel chain or store, this lets you transfer points to a huge list of partners and airlines that’s super useful. (That’s a benefit you don’t get if you only have one of the other lower-tier Chase cards mentioned below.).

The Biggest Points Hack: World of Hyatt

If you want the absolute best bang for your buck, you’ll definitely want to use your UR points along with the free World of Hyatt program.

Simply put, you just sign up for a World of Hyatt account (free), transfer your points to that account through the Chase portal, then use your points to book any Hyatt hotel for any time through their site.

While you can use your 60,000 points for $750 in travel using Chase’s portal, World of Hyatt offers an insane multiplier for the value of your points if you book through them.

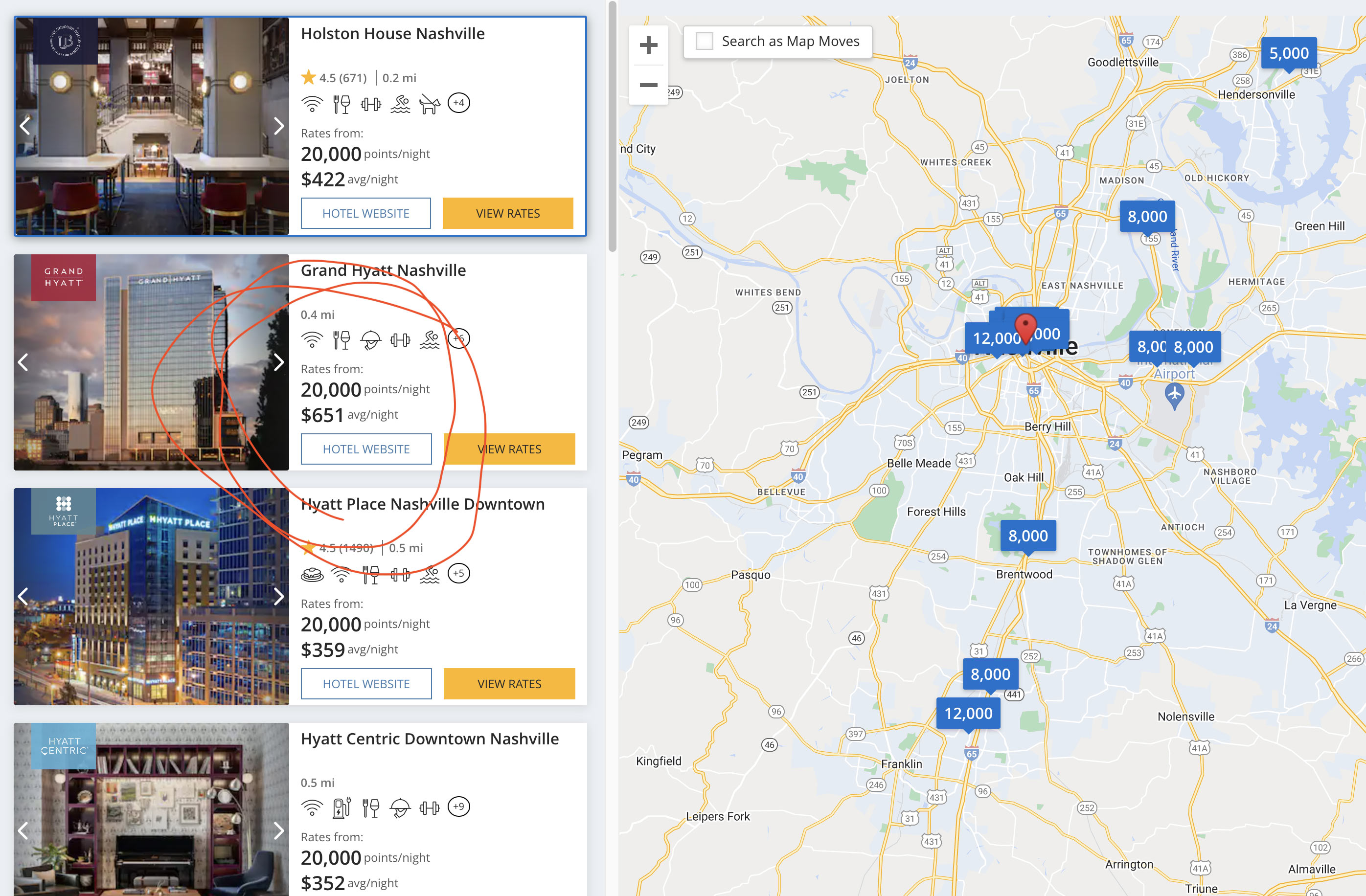

Looking at a fancy hotel in Nashville, for example, I could almost book one night at the $650/night Grand Hyatt with my 60,000 points as cash back, and that still doesn’t include daily resort fees. However, If I easily transfer those same points over to the free World of Hyatt program, I can book 3 FULL NIGHTS at the Grand Hyatt (no resort fees!) with my same 60,000 points. It’s pretty wild.

Of course, you can also book a week at a “normal” Hyatt hotel too, or whatever you want. For instance, most Hyatt Places can be found for about 9,500 points/night if you book a few months in advance. It’s one of the most ludicrous travel hacks out there.

You Next Two Cards (Plus 40,000 More Points)

Once those bonus points roll in, believe me, you’re going to want more points. The next two cards to get come with super easy bonuses, and unlock the easiest way to earn UR points through your regular weekly spending.

The next cards you want to pick up are the Chase Freedom Unlimited, and the Chase Freedom Flex. The order you get them is up to you, but these cards typically each come with a 20,000 point sign up bonus (for spending just $500 in 3 months) and give you some special superpowers for earning points. The Freedom Unlimited gets you 1.5x points on every purchase, and the Freedom Flex will allow you to earn 5x points on certain categories that change every quarter (gas, groceries, online shopping, etc). They both offer 3x points on dining, and neither have an annual fee.

Here’s why you want these cards next: Not only will you earn a 40,000 point total bonus for getting both cards, but these cards rack up UR points faster for daily spending than the Sapphire card does. The other giant perk is that you can transfer the UR points you earn with these to your Sapphire account, allowing you to use those points for the 25% bonus in the Chase travel portal or transfer those points to partners.

So there you go; just by signing up for a few cards and spending money you had to spend anyway, you can easily get 100,000+ points that can cover most of your next vacation.

Let’s talk about the next big hack: FREE FLIGHTS!

Stage Two: Free Flights With Southwest

Now that you’re racking up Ultimate Rewards points with Chase (best used on hotel stays and travel), it’s time to start flying for free (or at least insanely cheap). Southwest offers the best way to do that.

If you weren’t aware, Southwest offers a perk called the Companion Pass that allows you to book a free flight for a companion for every flight you book for yourself. In other words, because I have a companion pass, I can book a flight for me to Orlando and Lauren can fly with me for free (well, free-enough – you have to pay a $5 tax fee). This works for every Southwest ticket, so for a last minute flight that can cost upwards of $1,000, you can see how valuable this can become.

Here’s the thing – you have to earn 135,000 points in a calendar year to earn a companion pass, and that only lasts for the year you earn it and the following calendar year. That’s a lot of spending to pull that off. Here’s the good news – it’s comically easy to pull this off with credit card sign up bonuses!

Earn Your Companion Pass (+140,000 points!) in Two Moves

Once you have your Chase cards established, the next move is to grab both a personal Chase Southwest card, and then a Business Chase Southwest Card. The benefits of these aren’t nearly as good as the regular Chase cards we talked through earlier (unless you like some Southwest perks like early boarding and free WiFi on the plane), but you’re really just signing up for these to complete the welcome bonus offers. You’ll earn 60,000 points for the personal card, and typically 80,000 points for the business card; more importantly, just those point bonuses are enough to push you over the edge to qualify for a companion pass!

After that, not only will you basically have BOGO flights for you and your spouse, but you’ll also have a huge war chest of Southwest points to use to make even the paid flights “free” for you (one way flights are typically 15k points or so). It’s so valuable and easy to pull off that I’m shocked more people don’t take advantage of this. Just try to do this near the start of a calendar year so that your companion pass lasts as long as possible for you.

The Final Hack – Two Player Mode!

Something I was shocked to learn is that this whole system isn’t limited to one offer per household; both you and your spouse can complete all of these offers separately, and you can even get referral bonuses when one person signs up for a card that the other person already has. It’s kind of crazy.

What it boils down to is that you can easily earn hundreds of thousands of free points a year between the both of you, and EACH of you can earn a Southwest Companion Pass. For instance, any time our family of four flies with Southwest now, the two kids fly free and we pay for our adult tickets with the points we’ve built up.

It’s the craziest financial hack I’ve ever come across, and I could kick myself for not starting it sooner.

FAQ

Is this hard to keep up with?

Surprisingly not. Sign up for a card, and then simply route all spending through that one card (as much as possible at least) until you complete the sign up bonus. Wash and repeat as often as you like.

When we’re not trying to complete a bonus offer for a new card, we always fall back on either the Freedom Unlimited or Freedom Flex for normal out-and-about spending (due to how many points they earn).

The only “hard part” is reminding each other about which card we’re supposed to be using for the month.

Which card is best for which store?

The great thing about having several cards is that each of them offer different perks for different kind of purchases. If you want to maximize that value, you’ll want to use Card Pointers to stay on top of things.

Something we briefly discussed above is that Chase offers different points multipliers for different types of purchases (travel, dining, etc). The cool thing is that Chase also offers temporary points-back deals for different stores, partners, and more. These are great benefits, but its easy to miss out on those bonuses if you’re not checking every day for every card.

That’s where CardPointers comes in! They offer an incredible service with apps and extensions for just about every device you use to help you stay on top of the best card for every purchase. Shopping online? They’ll show a notification with the best card to use for the most points. Need to pick up something around town? Use the “near me” feature to see which store is offering the most points with your card purchase. It’s easy to use, and super handy, and you can get a special deal on CardPointers+ through this link.

Which card do you actually use the most?

If we’re not trying to complete a bonus offer, we almost always default to the Freedom Unlimited or Freedom Flex because of the high points for regular spending. If we’re making bigger or more category-specific purchases (travel for instance), we’ll use whichever card has the highest points back for that category.

How do you meet all of those spending requirements?

Honestly, I’m surprised by how easy it is to meet these spending requirements. When you route ALL of your monthly spending through a single card, it’s easy to hit $2,000 or $3,000/mo in spending no problem. Just think of all you spend on groceries, gas, eating out, paying bills, charitable giving, etc. It adds up quick!

Can’t you just use your Ultimate Rewards points with Southwest?

Yes, you can transfer your UR points to Southwest at a 1:1 rate, which is great, but those points are worth more through the Chase travel portal or a transfer partner like Hyatt. Also, any UR points you transfer to Southwest DO NOT COUNT toward points needed to earn a companion pass.

Why the Sapphire Preferred instead of the Sapphire Reserve?

There’s a big difference in annual fees ($550 for the Reserve vs $95 for the Preferred), although you do get bigger benefits with the Reserve (50% bonus on points through the Chase Travel Portal, airport lounge access, etc). It’s up to you if you want to treat yourself to bigger benefits at a bigger upfront cost 🙂

How many cards can I have at a time?

This is important – Chase has a 5/24 rule where each person can only newly qualify for 5 cards over a 24 month period. That’s not just new Chase cards – that’s 5 new credit cards of any kind. In other words, don’t waste your points potential on stupid store credit cards that barely earn you anything. Also, know that business cards typically don’t count to the 5/24 rule.

Can I get a business card?

Yes! Even if it’s just for a random side hustle, it’s pretty easy to qualify for a business card (like I recommend for the Southwest strategy above). Then just route all of your spending through that like normal to get the sign up bonus.

Can I repeat the bonus offers?

Yes, but they typically make you wait a while, and you have to cancel the card and sign up again. For instance, the Sapphire card only lets you earn that bonus once every 4 years.

Where do I start, and where do I sign up?

The very first card you want, in my opinion, is the Chase Sapphire Preferred. You can read more about that above. If you sign up for any card I mention, please sign up with my links from this page; it’ll help me earn even more points for my future vacations 🙂

Have questions? Leave them in the comments below. I hope these hacks supercharge your next vacation!

if you are a traveler so should listen music of your favorite artist on spotify application.